By Sahid Bangura

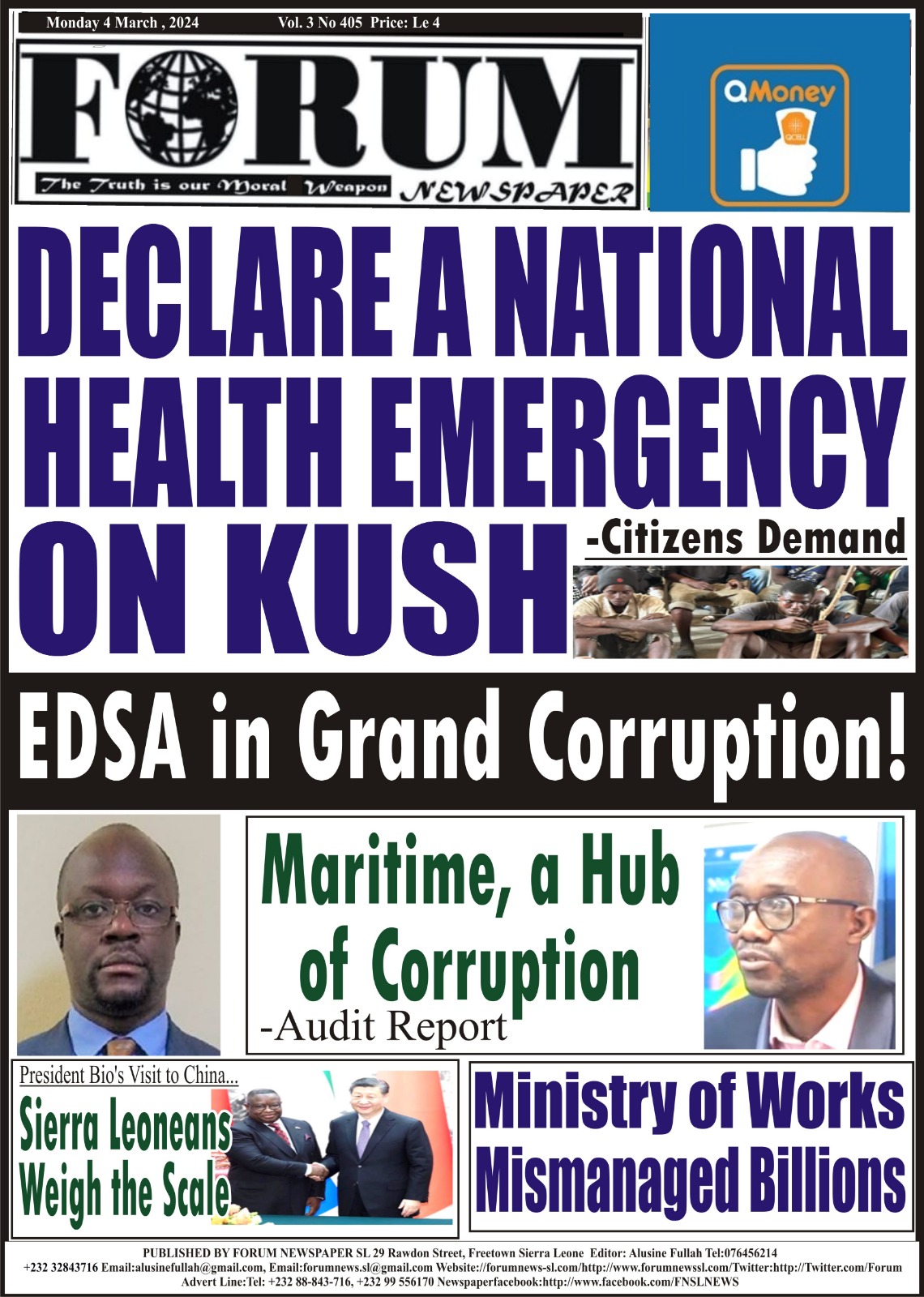

As the Audit Service Sierra Leone continues to execute its unwavering effort in exposing the hidden phases of public sectors, the Electricity Distribution Supply Authority (EDSA), after undergoing a thorough audit inspection, has been implicated of embezzling and mismanaging Billions of public funds.

During the Auditor’s inspection, “A review of the schedules of statutory deductions revealed that the GST charged on electricity sales, with net amount of SLE44, 598,614.89 was still owed to the National Revenue Authority at the end of 2022. This was in contravention of section 38(1) of the GST Act, 2009.” Also, a review of a significant difference of SLE301, 790,748 of the comparative figures recognized in the 2022 draft financial statement, was identified with the comparative figures recognized in the audited financial statement (2021).

An amount totalling SLE256, 906,513.75 was revealed as difference between the payable recorded in the draft Financial Statement and that of the trial balance. In response to asserted report, the management of Authority noted: “The slow payment of GST would be attributable to non-payment of MDAs bills and therefore the Authority constructed financial resources not even enough to meet the financial obligations of the Authority. Also most of the generation’s sources for input GST are exempted from GST.” The management continued that they had reconciled and reinstated the comparative figures for creditor balances, and that the differences between the draft Financial Statements and the trial balance have been agreed.

In response to asserted report, the management of Authority noted: “The slow payment of GST would be attributable to non-payment of MDAs bills and therefore the Authority constructed financial resources not even enough to meet the financial obligations of the Authority. Also most of the generation’s sources for input GST are exempted from GST.” The management continued that they had reconciled and reinstated the comparative figures for creditor balances, and that the differences between the draft Financial Statements and the trial balance have been agreed.

The Auditor commented that evidence of payment or payment plan with the NRA was not made available to the audit service, and the general ledger, accounting records, revised ledgers and financial statements were not provided to the Audit Service Sierra Leone, which left the issues of mismanaged funds amounting to SLE603,295,876.64, unresolved.

The audit also observed that assets obtained during the time of review were not marked with identification code, and that the value of assets procured for Office Equipment, and Furniture and Fittings were SLE1,482,465.31 and SLE307,000 respectively, and also noted that the location of assets replaced, were neither communicated to the team, nor made available for verification. “Assets apportioned to the Authority during the unbundling process in 2015 were not identified and appropriately recorded in the asset register.”

In response to the Management of the Authority, it was noted that they have made a request of hiring a competent firm to mark all the fixed in Freetown and the provinces, and continued that the consultant which was hired by the World Bank to split the assets owned by the NPA, has not been finalized his work. However, the Auditor, in regards with the marking of the Authority’s assets commented that their recommendation was not implemented, and that “the Authority has still not apportioned its assets,” which left the issues u resettled.

During the verification, the Audit team also observed that payments amounting to SLE311, 421 were made for both local and foreign travels for which the Authority failed to submit related documents such as letters of invitation, concept notes, back-to-office reports, receipts, and recipients’ signature. Thus, in review of the payment vouchers in regards with the monthly board allowances, the service observed that, “PAYE taxes amounting to SLE32, 670 were not charged and paid to the NRA.”

Payment totalling SLE150, 000, according to the audit service, were made as special impress to the Ministry of Energy’s account, however, “the rational for providing funding to a sub vented ministry was not provided for our review.” Also, it was reported that “an amount of SLE316,450 was spend in various organizations as donations, subscription or corporate social responsibilities for which no policy was made available to justify the disbursement of these funds.”

The management responded that the supporting documents in respect of traveling expenses were attached, and also noted that an amount of SLE32, 670 was paid to the NRA as the board remuneration. The management continued: “Although the MoE is a sub vented agency, a quarterly allocation of SLE150, 000 is to facilitate the work of the Ministry in terms of oversight functions of various projects since the quarterly allocation from the ministry is often not provided on time.”

Comments from the Auditor General noted that documents relating to foreign and local travel, evidence of payment of taxes due to the NRA, adequate justification stating why that money was procured for the Ministry of Energy, and Policy relating to corporate social responsibility were not provided for audit review, therefore, the issues were not resolved.

According to the audit service report, the Authority failed to provide the General Ledger Listing/ Cashbook and Bank Reconciliation Statement for Bank balances, and General Ledger Listing/ Cashbook and Reconciliation for cash balances amounted to SLE28, 552,164 and SLE189,568 respectively. “List of approved authorised signatories and ranks of personnel for the bank accounts,” according to the report, were not provided. However, the management of the Authority responded that all the documents were available for verification, but the Auditor General commented that the documents were not submitted during the verification exercise, noting that the issues were left unresolved.

The audit service also revealed that the Authority’s receivable balance (closing balance) as at the 31st December 2022, which amounted to SLE619,311,456 were not made available to the audit service, and also noted that when they compared the 2022 Trial Balance with the audited Financial Statements amount in 2021, they discovered an increase of 68% in the receivable balance.

In respect of the various electricity consumed by the offices of the Authority amounted to SLE1, 912,449 and SLE6, 550,170, noting that they said amounts were wrongly recognized as revenue and receivable balances respectively; the report added: “Upon review of the Receivable Balances, we noted that several amounts clarified as receivables have a total credit balance of SLE245, 005,667,” and concluded that the Authority failed to submit receivable ageing for the said period for audit inspection.

Response of the Authority’s Management noted that the increase of receivables was mainly attributed to non-payment of electricity bills by MDAs, and that the various electricity consumed by the Authority had been treated appropriately in the financial records. The management deemed the system as error from the outdated utility billing application and therefore rectified, and concluded: “The existing Utility 2000 billing application did not have module for age analysis.” However, the Auditor General comment, which recommended the Authority to submit supporting documents for the underlying issues were not implemented, so the issues were unresolved.