UBA is a high performance bank, with zero tolerance to complacency

UBA SL is now a dominant player in the banking sector in Sierra Leone and in other African countries. Could you explain the rationale behind this rapid growth?

United Bank for Africa’s consistent business growth in Sierra Leone is driven by the overall business objectives of the UBA Group. In UBA Sierra Leone, our business drive and initiatives are tailored towards the Group’s vision. The rapid growth in Sierra Leone and across 19 other African countries where UBA has a presence derive largely from the very clear strategic focus of the bank and its workforce as enshrined in our Vision Statement which is to become the undisputed leading and dominant financial services institution in Africa, driven through our Customer First (C1st) operating philosophy and execution mastery as a core value that permeates the system in the discharge of tasks and responsibilities assigned to every staff of the bank.

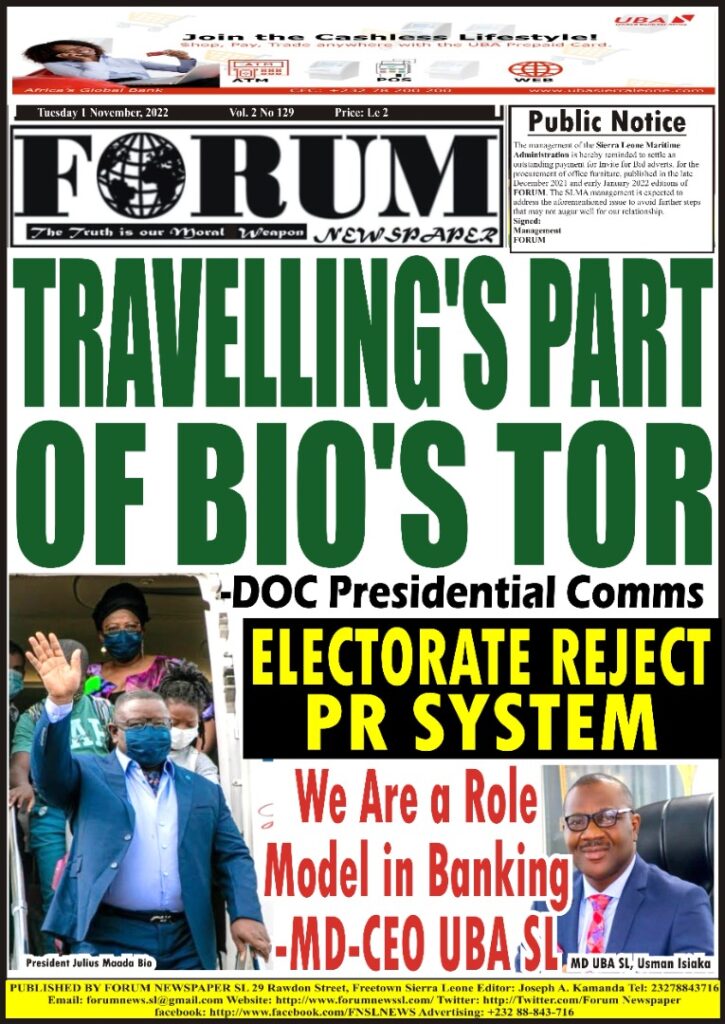

Overall, our Mission of being a role model for African businesses and delivering superior value to all stakeholders is a continuous driving force that encourages every staff to be at their best always with a view to building an enduring institution that will outlive all of us.

A testament to the above is the bank’s sterling performance in 2021 Audited Financial Statement. UBA Sierra Leone recorded a remarkable performance in the financial year with significant improvements across most parameters amidst the challenging year on a reassuring note despite the tumultuous impact and slow pace of recovery from the Covid-19 pandemic globally.

UBA closed the year 2021 with a balance sheet size of Le1.92 Trillion a growth of Le607.9 Billion representing a 46% increase compared to Le1.32 trillion in 2020. This growth was largely driven by growth in deposits from customers. Despite the challenging market situation, the bank recorded growth of 65% in customer deposits to close at Le1.3 Trillion at the end of the year compared to Le 787.4 billion in 2020 by leveraging on its digital prowess to provide 24/7 service to its customers via electronic channels to defy the Covid 19 constraints, the introduction of new deposit liability products like the Tier 1 and Tier 2 savings accounts, UBA Sharp-Sharp Savings Accounts, UBA Next Level Savings Account, UBA Extra, UBA Teens, UBA Dreams, UBA NextGen Savings Accounts and UBA Kiddies. The introduction of these retail liability products made a significant increase in the number of accounts opened in 2021FY. We have doubled the total number of accounts since inception of the bank in one year (2021) with a growth rate of 116%.

In a recent survey by this medium, UBA SL, under your watch, is the most responsive in customer relations, reflecting in robust growth in deposits and branches. How did you achieve these qualities?

I was redeployed to UBA Sierra Leone from UBA Tanzania where I was also the Country CEO in September 2020, right at the peak of the Covid 19 pandemic. The first thing I did was to engage all staff of the bank in a strategy session where we collectively agreed on our roadmap to attaining banking industry leadership position in the country within a 3 year timeline from 2021 to 2023 measured in terms of Profit Before Tax (PBT), Deposit Base, Risk Assets portfolio size and quality, customer base, digital banking products reliability, customer service standard, brand equity/top of mind awareness and corporate governance standard.

We agreed on the critical success factors and specific actions steps to drive this which include among others all staff operating with a high sense of urgency towards the discharge of their duties, excellent service delivery in line with our C1st operating philosophy, staff discipline and commitment to set goals, policy and regulatory compliance to ensure zero fraud loss and regulatory sanction and instituting highly motivating staff reward and recognition system in line with our People Happiness initiative. As CEO, I demonstrated leadership by example and operated with an open-door policy that enable every staff to believe in our course of action and put in their best towards delivering our set goals and objectives.

The results started manifesting within a timeframe of one year into our 3 years strategic intent with UBA Sierra Leone attaining the number one position in banking industry profitability (PBT) by the end of 2021 financial year much sooner than projected (2022) and also moved two steps upward in deposit ranking as Top 4. I am pleased to state that the bank is sustaining the leadership position in profitability with wider margin between our next competitor from January 2022 to date while we have also moved one step upward on deposit ranking as Top 3 with a market share of over 13% that makes UBA a Systemic Important Bank (SIB) in the country.

I must say that our collective determined focus on superior customer experience by every staff going the extra miles to delight our customers at every point of interaction and the strong management commitment to our People Happiness initiative on the back of the wonderful support we receive from our Board and parent company, UBA Plc in Nigeria are the magic wands that produced the excellent results recorded by the bank within these first 2 years of my tenure as the Country CEO.

In specifics, between August 2020 and August 2022, we have achieved the following significant milestones in our drive to attaining industry leadership among others:

- Doubled our deposit base from SLE 703.77 million (new Leones) to SLE 1.694 billion, a 141% increase.

- Our Net Loans increased by 204% from SLE68.5m to SLE208.32 million with an impressive Non-Performing Loan ratio of less than 1%

- Doubled our Balance Sheet size (Total Assets) from SLE1.24billion to SLE2.547 billion, a 105% increase.

- Significantly increased our customer base from less than 100,000 to about 400,000.

- Increased our branch network from 7 to 10 with 2 additional Cash Centres.

- Launched 7 retail liability products into the market to improve financial inclusion in the country

- Improved UBA brand equity and top of mind awareness

Undoubtedly, the bank’s commitment to being a responsible corporate citizen through our various CSR initiatives in the country has had significant positive impact on our business growth. You will recall that at the advent of Covid 19 pandemic in 2020, UBA was the first bank to make a high value corporate donation of the sum of SLL 1.5 billion (old leones, about $150,000) to the Government of Sierra Leone to support their drive in combating the negative menace of the global pandemic in the country. This is part of a total sum of $14m which UBA Group donated to all the Governments of the 20 African countries where we operate in line with our business philosophy of doing well financially and doing good to our host community.

Also, within my first year of resumption, we launched the UBA Annual National Essay Competition (NEC) for Senior Secondary School examination students which provides a total sum of Le100m old leones as grants to the Top 3 winners to further their education in any African University of their choice and brand-new Laptops to all the 12 Finalists. We have ran this programme for two years so far and the third edition is scheduled to commence in November 2022 as a lasting legacy to support the growth of quality education in the country.

Our primary strategy is to continue to focus on providing excellent services to our customers in line with our Customer First (C1st) Philosophy and strong commitment to delighting our customers at every point of interaction under our CX initiatives. Also, as part of the drive to widen our financial inclusion, bank the unbanked and underbanked in the country, the Bank rolled out three more branches one at the Western Area rural community at Adonkia, the 2nd at the Western Area Urban community in Wellington industrial estate and more recently the 3rd branch at Waterloo which increased the total number of branches in the country to 10 (ten) plus 4 cash/ATM Centers.

Your style of leadership is what makes you tall. Customers and staff say you are a team player, a likeable and a focussed personality, reflecting in rapid growth of the bank. Please explain further.

To be an authentic transformational leader that aims to take his institution to unparalleled high-performance standard, you must give priority attention to people issue, be a good listener, run an objective and transparent system that enables every staff see clearly what is expected of them and what is in it for them. As a leader, recognize and celebrate performers and like a whirlwind it will make the spirit of high-performance standard permeate the entire system within a short period of time. Good performance is infectious among staff when driven with the right organizational policies and leadership practices as it leads to goal congruency with staff members achieving their individual goals just as the bank achieves its corporate goal! Within my two years tenure we have recorded impressive staff tenure review and year on year staff promotion impacting over 40% of the total workforce of the bank, and this is why I will also attribute the rapid growth of the bank to the good support received from our dynamic Board and Group Office towards the achievement of our People Happiness goal.

How will you sustain this growth trajectory of the bank?

Despite the highly competitive operating environment, we leveraged our franchise and deepened our market share across our key focus sectors by increasing our share of existing customer’s wallet while also on-boarding new customers. We are particularly pleased with the growth in our retail and corporate deposits which is a testament to our investment in service channels, digital banking offerings and renewed focus on superior customer experience across all our contact points. In this area, on the 26th March 2022 at the Gigibonta Car Park, Freetown, we launched the UBA Digital Wan Pot Campaign geared towards enrolling all UBA customers on UBA’s digital platforms. The growth in retail deposits which is largely a stable, low-cost source of funding, provides further stability to our balance sheet and reinforces a stronger outlook in the years ahead.

Let me add by saying UBA Group is a high performance driving institution that does not tolerate complacency in any form. We are always in a state of continuous improvement. Our capabilities are derived from our Group’s robust financial strength, proven competence, strategic alliances and commitment, which we combine to professionally drive the benchmark for exceptional value delivery to our esteemed customers. This and our determined focus on attaining industry leadership will continue to propel us to sustain our growth trajectory leveraging on our people, process, technology, customer first operating philosophy and 3 Es Core Value of Enterprise, Excellence and Execution.

We believe that the banking space in Sierra Leone is still largely untapped with a financial service penetration ratio of less than 25%. We will drive financial inclusion using our digital prowess, introduction of customer centric products and services and expansion of our branch network/service outlet through the soon to be rolled out UBA agency banking platform to bank the large number of unbanked and underbanked members of the public across the country.

Let me use this medium to thank our esteemed customers for their continuous patronage that is contributing significantly to the sterling performance of the bank, the Board for their unceasing support that is a source of encouragement to all staff and management in our journey towards making UBA Sierra Leone the undisputed leading and dominant financial service institution in the country.

SOURCED: THE NEWS MAGAZINE, NIGERIA