By Kateryna Boguslavska, Head of Financial Crime Risk and Monica Guy, Senior Specialist Communications, at the Basel Institute on Governance

It is with some trepidation that we inform GAB readers of the latest Basel AML Index Public Edition results.

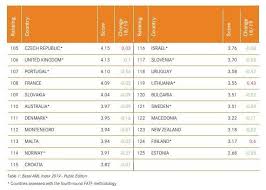

That is because the Basel AML Index is widely known as a ranking of jurisdictions – 177 this year – in terms of their risks of money laundering and related financial crimes. We all know how contentious jurisdiction rankings can be, especially in hard-to-measure topics like financial crime.

So we would like to stress from the outset an important point about this year’s Index.

The tiny shift we see this year in the global money laundering risk score – from 5.30 down to 5.28 – is basically insignificant. At least it is not rising, though! That is some hope in the current climate.

We emphasize that the Index seeks to measure risks of money laundering, not actual amounts of money laundered in a jurisdiction. It does this based on 17 indicators of publicly available data. These indicators are weighted according to a composite methodology that is assessed each year by an independent and diverse group of experts.

On the regional picture: jurisdictions that have long struggled in the rankings are making faster progress in strengthening their anti-money laundering and counter financing of terrorism (AML/CFT) frameworks, especially in Sub-Saharan Africa. At the same time, some traditionally strong jurisdictions in terms of AML/CFT are slipping back. These trends could be reversed next year as new data becomes available and new risks evolve. But at least this mini trend gives pause for thought.

What is lower risk?

More interesting to GAB readers might be our call to focus not just on high-risk jurisdictions but also on those that present lower risks of financial crime, based on the available data.

Our feature highlights how this could help financial institutions and supervisors apply the risk-based approach – a cornerstone of anti-money laundering compliance and supervision – more proportionately. In turn, that might help them use their limited resources more effectively and reduce negative consequences for financial inclusion.

Assessing virtual asset risks

We also look at how to assess risks related to virtual assets, a fast-growing issue that few have a strong grasp of. We warn against relying solely on country indices of virtual asset adoption or illicit use published by blockchain intelligence firms. Instead, we advise readers to look at the structural weaknesses – like high exposure to crimes such as fraud and drug trafficking, weak rule of law and poor performance in certain FATF criteria – that enable money laundering using any form of value, not only virtual assets.

Beyond the headlines

In truth: These days it is hard to get most people to look behind headlines like “Finland best, Myanmar worst countries for money laundering” or beyond their overall risk score in comparison to others in their region.

So it is encouraging that we are already seeing sensible discussions about what structural issues might be driving the changes in money laundering risk scores.

As GAB followers are most likely to be having those types of sensible discussions, we would like to draw your attention to the Expert Edition options, which are totally free of charge to public-sector, non-profit, academic and multilateral organizations plus the media.

There you can filter for the 17 indicators and see jurisdictions’ risk scores in their wider context. You can also view sanctions and risk lists and more. Money laundering nerds may also enjoy the Expert Edition Plus (also free for the above categories), which has a detailed numerical and written analysis of FATF mutual evaluation and follow-up reports.

Dive in, get in touch

You can see the news release here, report here, public ranking here and launch event here, which includes a run-through of the key findings plus a discussion with Ned Conway of The Wolfsberg Group, Jean Phillipo-Priminta of the Financial Intelligence Authority Malawi and Nico Di Gabriele of the European Central Bank.

Any questions, ideas, suggestions or requests, please write to us at index@baselgovernance.org.