By Donstance Koroma

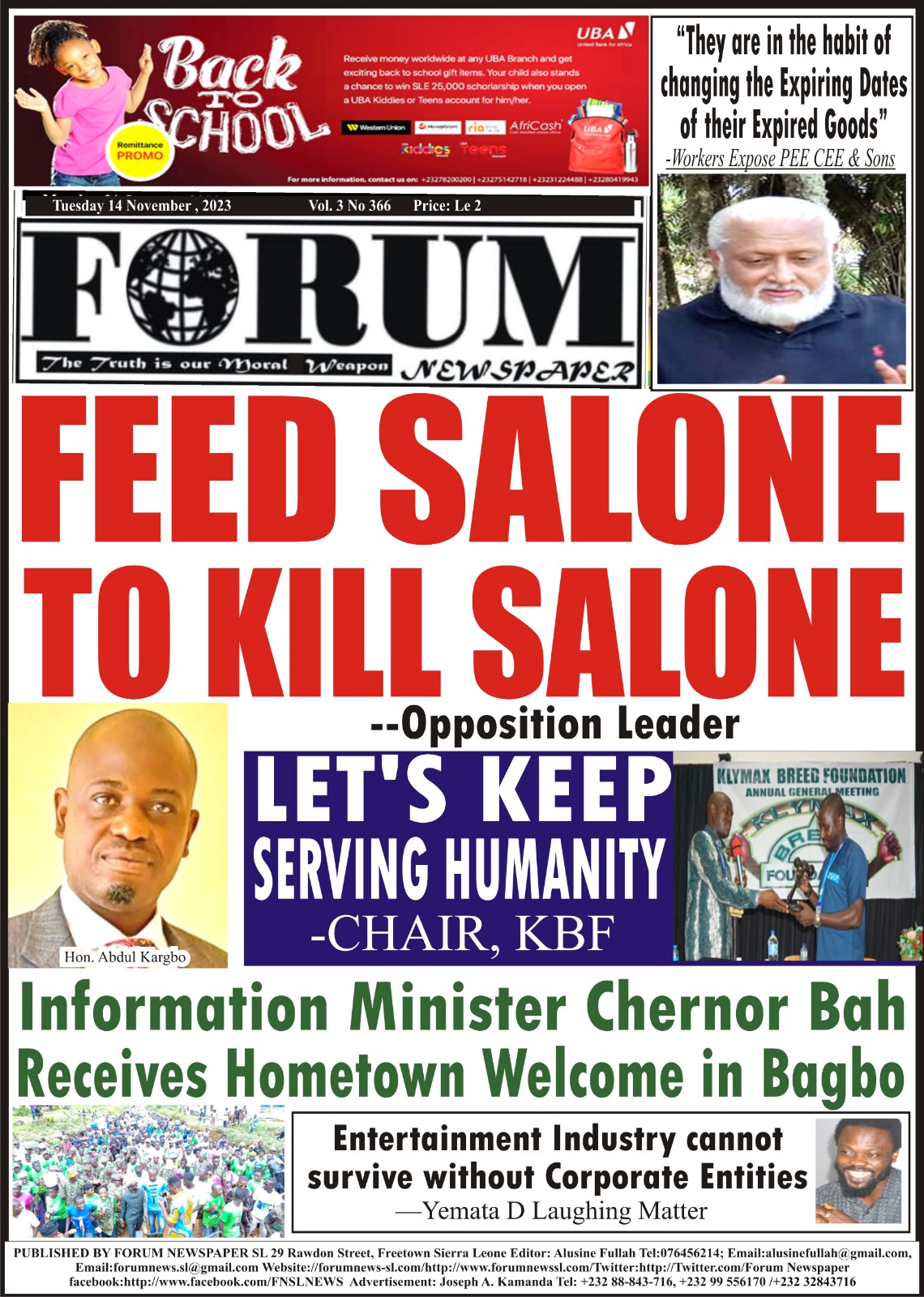

The Leader of the Opposition in the House of Parliament Hon. Abdul Kargbo who was having his bit during the debate of the country’s 2024 budget described the government much trumpeted Feed Salone Initiative to be Kill Salone.

The leader was raising concern over the government decision to increase Excise duty on rice from zero to five percent, which the lawmaker told the house that he can’t just comprehend the reason behind the government decision.

Hon. Abdul Kargbo recalled that in 2021, the SLPP government suspended excise duty on rice, yet , the country’s staple food became more expensive more than when excise duty was not suspended.

This prompted the leader to ask the government why excise duty on rice was suspended, “Issues of such nature pains me because they wanted to politics it , to me is a disservice, which we must pay due diligence” Leader of the Opposition.

The leader argued that restoring excise duty on rice will not change anything, as the price of rice will skyrocket rapidly.

According to Hon. Abdul Kargbo, the reason put forward by the government for the restoration of the 5% excise duty on rice is because the government flagship project ‘Feed Salone’ will cultivate and harvest rice.

On the contrary, the opposition leader prefer the government to maintain the zero excise duty until the country start the cultivation and harvesting of rice, otherwise feed Salone has the potential of becoming kill Salone.

Mr. Speaker, Honorable Members, citizens of Tamabon haven’t eaten a seed of rice from the government Tamabon rice project, reminding all and sundry that their duty as MPs is to provide solutions to their people they are representing , especially the one that has to do with police that will reduce economic burden , the APC legislator said.

According to the leader of the opposition, the decision of the government to increase 5% of excise duty on rice can be interpreted thus: “We are starving now because we want to feed you tomorrow”, which he furthered in itself questions the productiveness of the Feed Salone.

He therefore called on the government to suspend excise duty on rice for another year to enable the government to measure the productiveness of Feed Salone and also gives consideration to the SLPP supporters that sang and danced for them under rains. Hon. Abdul Kargbo also warned the government to move away from aggressive tax collection that will cause untold hardship on the ordinary man.

Mr. Speaker , Honorable members, regardless of the fact that the government is assuring the public about companies on the verge of setting up while other has commenced production, we just cannot make laws on things we don’t see, Hon. Abdul Kargbo .

He continued that the 2021 Audited Report revealed that a whooping sum of 187.3 billion leones was unaccounted for by MDAs but nobody was investigated, recalling that in 2018, the country’s Anti-Corruption Commission (ACC) that he said is currently in deep slumber was busy inviting opposition regularly for corruption related charges. The Leader of Government Business , Hon. Mathew Nyuma started by saying that as a government they are doing the right thing at the right place for the good of the country.

He noted that as lawmakers, they are supposed to examine imposition and alteration in support of the government fiscal policy for the year 2024. Hon. Nyuma disclosed that in the government fiscal policy for the year 2024 rice, cement attract import duties yet, the government was able to reduce inflation rate from double digits to single digit.

“For the previous five years it was zero tax on imported rice , never the less, the zero excise duty on rice let us in suffering “ Leader of Government Business said.

We all get it wrong, from 60,000 to 400,000, the leader of Government Business admitted, but also reminded the opposition that the government of Late Dr. Ahmed Tejan Kabba left 500 billion leones as reserve that the government of Dr. Ernest Bai Koroma inherited .

The Leader of Government Business called the tax increase on rice , cement and iron rod as justifiable shift on the grounds that for the past years the government decided to reduce taxes on those commodities , yet, importers of those items failed to live up to expectation as prices of those commodities were chasing the sky, he noted.

The Minister of Finance, Fantamadi Bangura said with regards the ministry medium term level strategy, the government is guided by a gradual and sustain revenue mobilization and as such the aggressive task collection measure is not in any way to induce suffering on the people but rather a justification that is mindful of small businesses and industries.

The minister added that the propose restoration of 5% on import duty on rice will spark the rice debate in respect to its importation, production and consumption.

The minister added that 75% of rural communities grow rice but still the government spends over 200 million dollars on the importation of rice that he said is with no real value.

The Minister informed the House of Parliament that Sierra Leone has the ecology to grow rice to make the country self-sufficient, hence the reason why the government taxes the importation of rice appropriately.

He told parliament that the ministry intends to institute a price formula to rationalize the shift in the prices of certain commodities.

Mr. Speaker, Honourable Members, exemption on inputs, machineries, plants and equipment’s for the cultivation of rice is provided for in the country’s 2024 fiscal policy, the minister told MPs.