By: Zacharia Jalloh, Strategic Communications Unit, Ministry of Information and Civic Education

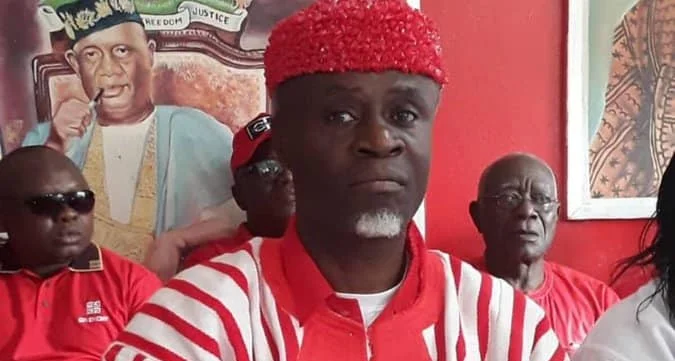

The Ministry of Information and Civic Education’s press conference on Tuesday, 11th February 2025, provided critical updates on diplomatic engagements, legal matters, and financial innovations in Sierra Leone. Minister Chernor Bah shared details about the joint judicial investigation between Sierra Leone and Guinea, progress on the Dutch extradition request, and a deportation notice from the United States. Additionally, the Governor of the Bank of Sierra Leone, Dr. Ibrahim Stevens, announced the launch of the Instant Payment Service under the National Payment Switch, aimed at revolutionizing financial transactions in the country. The following are the key highlights:

♦ Diplomatic Agreement on Joint Judicial Investigation with Guinea

The Minister of Information and Civic Education, Chernor Bah, announced that Sierra Leone and Guinea have signed a Memorandum of Understanding (MOU) for a joint judicial investigation into a drug-related matter. This agreement follows a series of diplomatic engagements between the two countries and is in accordance with Articles 3, 18, 19, 20, and 21 of the United Nations Convention on Transnational Organized Crime of 2000.

The Minister of Information and Civic Education, Chernor Bah, announced that Sierra Leone and Guinea have signed a Memorandum of Understanding (MOU) for a joint judicial investigation into a drug-related matter. This agreement follows a series of diplomatic engagements between the two countries and is in accordance with Articles 3, 18, 19, 20, and 21 of the United Nations Convention on Transnational Organized Crime of 2000.

Minister Bah disclosed that the Sierra Leone Ambassador to Guinea, Ambassador Alimamy Bangura, accompanied by Foreign Affairs Minister Timothy Kabba, has returned to Sierra Leone from Guinea. The Ambassador and the Head of Chancery are expected to brief Sierra Leonean authorities on the developments soon.

♦ Update on Dutch Extradition Request

Minister Chernor Bah provided an update on the Dutch government’s extradition request. He confirmed that on Thursday, 6th February 2025, the Dutch authorities delivered a sealed document to the Sierra Leone embassies in Ghana and Brussels, addressed to the Attorney General and Minister of Foreign Affairs. The documents were forwarded to Freetown on Sunday, 9th February 2025, and were received by Attorney General and Minister of Justice, Alpha Sesay, on Monday, 10th February 2025.

Minister Chernor Bah provided an update on the Dutch government’s extradition request. He confirmed that on Thursday, 6th February 2025, the Dutch authorities delivered a sealed document to the Sierra Leone embassies in Ghana and Brussels, addressed to the Attorney General and Minister of Foreign Affairs. The documents were forwarded to Freetown on Sunday, 9th February 2025, and were received by Attorney General and Minister of Justice, Alpha Sesay, on Monday, 10th February 2025.

The documents will undergo a thorough review by the Attorney General, who will provide the necessary legal advice. Minister Bah emphasized that Sierra Leone is committed to upholding the rule of law and will adhere to the procedures stipulated by the 1974 Extradition Act.

In addition, Minister Bah disclosed that Sierra Leone had previously made two requests to the Dutch government for the extradition of “Adebayor” to face justice in Sierra Leone for alleged atrocities and incitement of violence, but no action was taken. He noted that Sierra Leone’s Foreign Minister and Attorney General visited the Netherlands and submitted all relevant evidence and documentation.

♦ Deportation Notice from the United States

The United States Government has issued a deportation notice for 11 individuals alleged to be Sierra Leonean citizens. Minister Bah revealed that the Ministry of Internal Affairs and the Ministry of Foreign Affairs are working together to conduct thorough due diligence to confirm the individuals’ citizenship status before taking further action.

♦ Introduction of Instant Payment Service: National Payment Switch

Dr. Ibrahim Stevens, the Governor of the Bank of Sierra Leone, announced the launch of the Instant Payment Service under the National Payment Switch initiative. This service will enable instant money transfers between banks and mobile money platforms, enhancing the efficiency and speed of financial transactions.

The Instant Payment Service will be officially launched by the Honourable Vice President, Dr. Mohamed Juldeh Jalloh, on Thursday, 13th February 2025. Currently, seven banks, including Sierra Leone Commercial Bank, Rokel Bank, Sky Bank, GTBank, Zenit Bank, Access Bank, and Commerce and Mortgage Bank, have connected to the service, along with the two major mobile money operators, Orange Money and Afrimoney.

♦ Registration and Full Integration Timeline

Citizens are encouraged to register for the service through participating banks or mobile money operators using their telephone number and national identification card. The Bank of Sierra Leone has set a deadline for full integration, requiring all banks and mobile money operators to join the National Payment Switch by 1st April 2025.

Dr. Stevens assured the public that necessary mechanisms are in place to address any challenges banks may face during the integration process.

♦ Significance and Security of Instant Payment Service

Velma Labor, the Representative of the Association of Commercial Banks, highlighted the benefits of the Instant Payment Service, emphasizing the following:

Speed and Efficiency – Transfers occur within 10 seconds, even on holidays or after banking hours.

Convenience and Security – Customers can transact from the comfort of their homes, reducing the risk of carrying large sums of cash.

Enhanced Security – Transactions are protected by a One-Time Password (OTP), ensuring customers’ funds are safe from unauthorized access.

♦ Industry Endorsement and Economic Impact

David Mansaray, CEO of Orange Money, lauded the introduction of the Instant Payment Service as a game-changer for Sierra Leone’s financial sector. Reflecting on his two decades of experience, he emphasized that the system enhances financial inclusion and provides a credible financial transaction history, assisting banks in assessing customers’ loan eligibility.

♦Martinson Obeng-Agyei, CEO of Afrimoney Sierra Leone Limited, announced that Afrimoney would go live on the Instant Payment Service on 12th February 2025, in collaboration with Orange Money. Customers will receive detailed instructions on registration and usage.

CEO Martinson highlighted the service’s role in empowering small businesses, allowing them to efficiently manage transactions without the stigma of maintaining minimal bank balances.