By Hassan Osman Kargbo

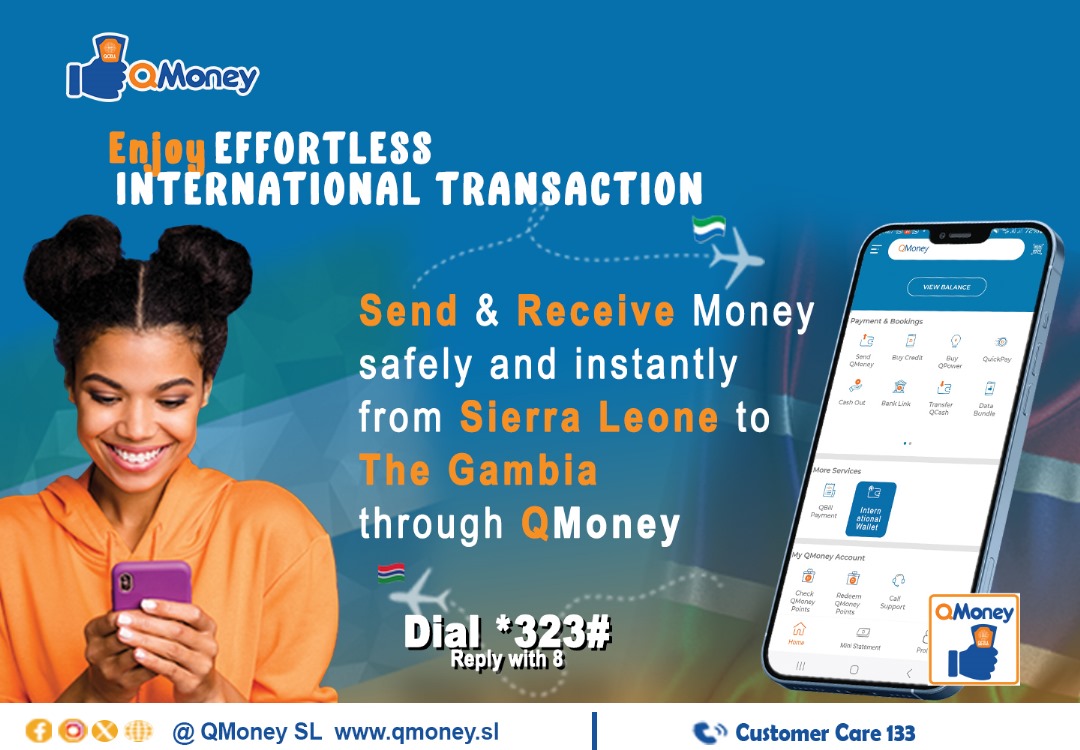

QMoney has officially launched its Cross Border Transfer Service, enabling customers to send and receive money instantly between Sierra Leone and The Gambia. The new service marks a major milestone in regional digital finance, offering fast, secure, and affordable money transfers designed to meet the everyday needs of individuals and businesses.

The launch introduces a new level of convenience for families, traders, students, and entrepreneurs who rely on regular financial support across borders. With the service now live, users can complete transactions within seconds using their mobile phones, eliminating long queues, delays, and the stress often associated with traditional cross border transfers.

According to QMoney, the initiative reflects its commitment to expanding financial inclusion and strengthening economic ties between neighbouring countries. The service is designed to make cross border payments as simple as local transfers, allowing users to move money effortlessly while staying connected to their loved ones and business partners.

QMoney explained that customers can access the service by dialing *323# or by using the QMoney mobile application. The platform is powered by QCell’s trusted mobile financial services, ensuring a high level of security and reliability for every transaction.

One of the key features of the new service is speed. Transfers are completed almost instantly, allowing recipients to access funds in real time. This is particularly beneficial for urgent family needs, business transactions, and daily expenses that require immediate settlement.

Affordability is another major advantage. QMoney said the service is designed with competitive fees to make cross border support more accessible to ordinary users. By keeping costs low, the company aims to ease the financial burden on customers who frequently send money between Sierra Leone and The Gambia.

Security also remains a top priority. QMoney assured customers that the platform is fully secure, with robust systems in place to protect user data and funds. The service operates within a regulated mobile money framework, providing confidence and peace of mind to users.

The company further highlighted its wide agent network across both countries, which allows customers to easily deposit and withdraw cash at reliable locations. This ensures that even users without smartphones or bank accounts can benefit from the service.

With families and businesses increasingly connected across the region, QMoney said the cross border transfer service will play a vital role in supporting trade, education, and social ties. The company described the launch as a step toward greater financial freedom and regional integration.

With families and businesses increasingly connected across the region, QMoney said the cross border transfer service will play a vital role in supporting trade, education, and social ties. The company described the launch as a step toward greater financial freedom and regional integration.

QMoney encouraged customers to start using the service immediately by dialing *323# or downloading the QMoney App. The company reaffirmed its commitment to innovation, accessibility, and customer empowerment under its tagline, Your Money. Your Freedom. Across Borders.