By Mackie M. Jalloh

Rokel Commercial Bank (RCBank) will celebrate its 25th anniversary on September 17, marking a remarkable journey since its establishment in 1999, following the transfer of ownership from Barclays PLC, which had held a stake in the bank since 1917, to the government and people of Sierra Leone. While the transition heralded a new era for the bank, RCBank faced numerous challenges, especially during and after Sierra Leone’s civil war in the 1990s. Despite experiencing growth in its early years, the bank found itself in financial decline post-war, struggling with liquidity and solvency issues.

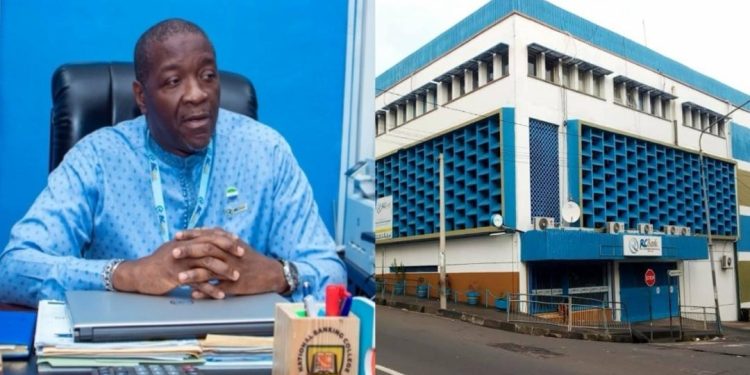

By 2013, the Sierra Leonean government intervened with a financial bailout, recapitalizing the bank and obtaining a 65% ownership stake. While this helped stabilize the bank, deeper issues remained. It wasn’t until 2017, when seasoned economist and financial expert Dr. Walton Ekundayo Gilpin was appointed as Managing Director, that RCBank began its dramatic turnaround. Gilpin’s leadership focused on bold and strategic reforms, transforming RCBank from a floundering institution into one of Sierra Leone’s most profitable and resilient banks.

A major element of the bank’s recovery was its ambitious rebranding and marketing strategy. With a new logo and heightened public outreach, the bank began rebuilding public trust and expanding its customer base. These efforts saw a surge in deposits, improved capital adequacy, and a significant rise in performing loans. In just one year, profits skyrocketed from Le1.5 billion in 2016 to Le64 billion in 2017, signaling the start of a new chapter for the bank. By 2020, RCBank’s profits had reached an impressive Le83.5 billion, and for the first time in decades, the bank was in a position to pay dividends to its shareholders.

In addition to financial gains, RCBank’s transformation was driven by the implementation of a robust IT infrastructure, which introduced a secure and user-friendly core banking system. This system has significantly reduced wait times in banking halls and facilitated near-paperless transactions. One of the bank’s standout innovations has been the introduction of its mobile banking platform, Rokel SimKorpor, which has become a key revenue source while also generating direct and indirect employment opportunities.

RCBank has also expanded its range of services to include cutting-edge electronic banking products such as prepaid cards, credit cards, Visa cards, ATMs, and international money transfer services through MoneyGram, Western Union, and Ria. These services have earned praise from customers and positioned RCBank as a leader in Sierra Leone’s banking sector.

As part of its broader mission, the bank has focused on financial inclusion, particularly through its SME loan scheme launched in 2021. This initiative, aimed at small businesses with little or no collateral, has offered low-interest loans and flexible payment plans, benefitting sectors such as market women and Okada riders.

Today, RCBank’s digital platforms serve prominent organizations, including NACSA, TSC, UNDP, and the World Bank, facilitating payments for employees and vulnerable groups through social safety nets. Looking forward, the bank continues to strengthen relationships with international financial institutions and remains committed to driving financial inclusion across Sierra Leone.