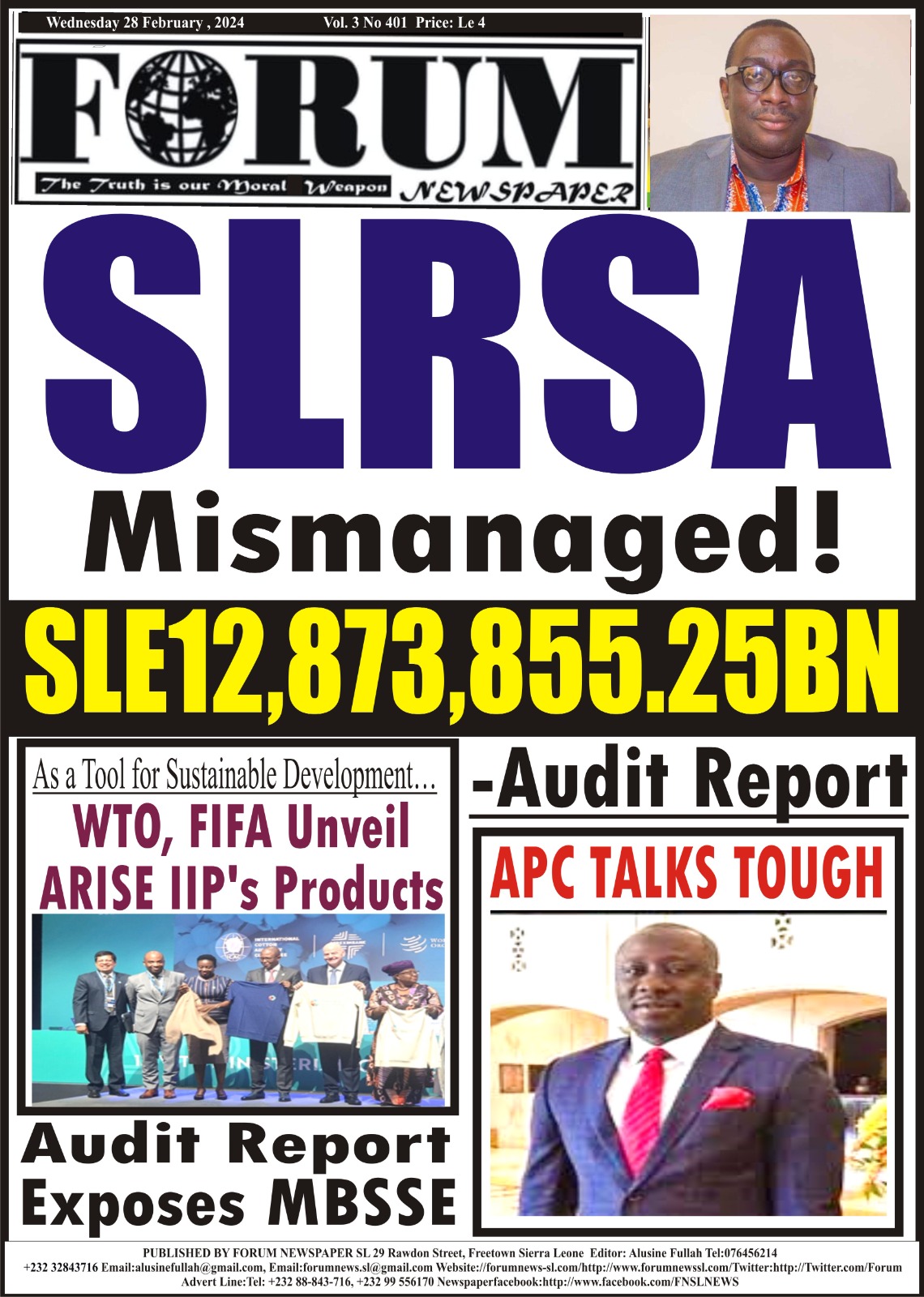

SLRSA

SLE471, 600

SLE1, 301,458

SLE1, 301,458

SLE212, 700, SLE2, 159,605

SLE3, 387,654.83,

SLE471, 600

SLE471, 600

SLE1, 633, 312, .42,

SLE1, 462,867

Mismanaged!

—Audit Report

By Sahid Bangura

In a ground breaking revelation, the Sierra Leone Road Safety Authority, after undergoing a thorough inspection through the Audit Service Sierra Leone, which provides the public with adequate incite of annual reports of the public service sectors, has been implicated of embezzling Billions of Leones. In respect of the revenue management system, the audit service revealed that between January and December 2022, the Kenema Branch generated a total amount of SLE471, 600 from the insurance of licences, and that the generated fund reflected on the pay-in slips and we’re stamped and signed by the bank, but the audit service could not trace the payment of the bank account.

In respect of the revenue management system, the audit service revealed that between January and December 2022, the Kenema Branch generated a total amount of SLE471, 600 from the insurance of licences, and that the generated fund reflected on the pay-in slips and we’re stamped and signed by the bank, but the audit service could not trace the payment of the bank account.

Due to the failure of the headquarters and outstations of the Authority in doing daily and monthly reconciliation with the various banks, according to the audit report, “This was evidence by the fact that there was a difference of SLE1, 301,458 between the revenue deposited at the various banks and revenue recorded in the Vehicle and Driver Licence System.” Also, the audit service identified a difference of SLE161, 514 between revenue amount as per the Financial Statements and amount as per the general ledger.

In regards with clamping, circulation permit and traffic offenses, amounts totalling SLE212,700, SLE2,159,605 and SLE3,387,654.83, respectively, were recorded as revenue, but according to the audit service, “source document such as duplicate receipts, breakdown of totals and pay-in slips were not provided for audit review.”

In regards with the revenue generated by the Kenema Branch, the management of the Sierra Leone Road Safety Authority affirmed that they received receipts, but the said deposits were not made in the SLRSA account, noting that the Kenema station had formed a committee to look into the claims of payment for which could not be traced by the Authority’s bank account; they admitted that they had taken a management decision to recover the said amount.

The Authority’s management, in response to the daily and monthly reconciliation with various banks responded that the management had discussed the said issues, and noted that all stations including headquarters must be doing their daily reconciliations. In nexus to the unreview clamping, circulation permit and traffic offenses, the management noted: “Freetown- It has also been agreed from the findings that source documents are available for services relating to clamping, circulation permit and traffic offenses which can be submitted during audit verification.”

The Auditor General commented that “Evidence to indicate that revenue amounting to SLE471, 600 was paid into the Bank was not submitted, evidence of reconciliation undertaken was not submitted, evidence of adjusted financial statements was not submitted, and the relevant supporting documents regarding funds states above were not submitted for audit verification.” The management confirmed that the issues were unresolved.

During the review of the recurring transit and rent deposit in the financial statements of the Authority, the audit service disclosed that a schedule which showed funds totalling SLE1, 750,376 and SLE281, 444.44 were recorded as transit and rent respectively, and noted that the said record had been appearing constantly in the Authority’s Financial Statements; the report recorded: “We further no action has been taken to identify customers for the specific deposits.”

Following the recommendation of the Auditor, which called to attention the Finance Director in ensuring customers are identified for all deposits and making the necessary adjustments to the receivable balance, got a response from the management of the Authority admitting to take into consideration the Auditor’s recommendations and to do the necessary adjustments accordingly. However, at the conclusion of the inspection in regards with the transit and rent deposit, the Auditor commented that the SLRSA did not submit any evidence of the necessary adjustments to the receivable balance.

The report revealed that “The opening balance of unpaid fines was recorded as SLE1, 633, 312,.42, but no evidence of action plan was provided by the Authority to recover the said fines.” The Audit Service noted that the unpaid fines might continue to increase and would affect the revenue drive of the Authority.

In response to the unpaid fines, the management responded that the Director of HR/Administration had been informed accordingly, and would ensure its availability, and assured that, in regards with the unpaid fines, they would make the necessary adjustments in the 2023 account. However, the Auditor commented: “During the verification, evidence of adjustment and disclosure in respect of unpaid fines was not submitted. The issue remains unresolved.”

According to the audit report, pay as you earn (PAYE) taxes amounted to SLE1,462,867, and that the taxes were not deducted and paid into the NRA. After a recommendation of the Audit Service, which states that the Financial Director should ensure that the PAYE taxes are deducted and paid into the NRA and evidence to be submitted to the Audit Service Sierra Leone, the Auditor General commented that the management failed to respond to the audit finding, and failed to provide evidence to suggest that their recommendation was implemented, which left the issue unresolved.