Sierra Leoneans find themselves in an unenviable position of being a poor people in a rich land. The country that was far ahead of almost all British possessions in Africa in terms of progress and education has found its fortunes dwindling over the years. The country has failed to live up to expectations from its stellar beginning, and is now dwindling at the bottom of every human and economic development index.

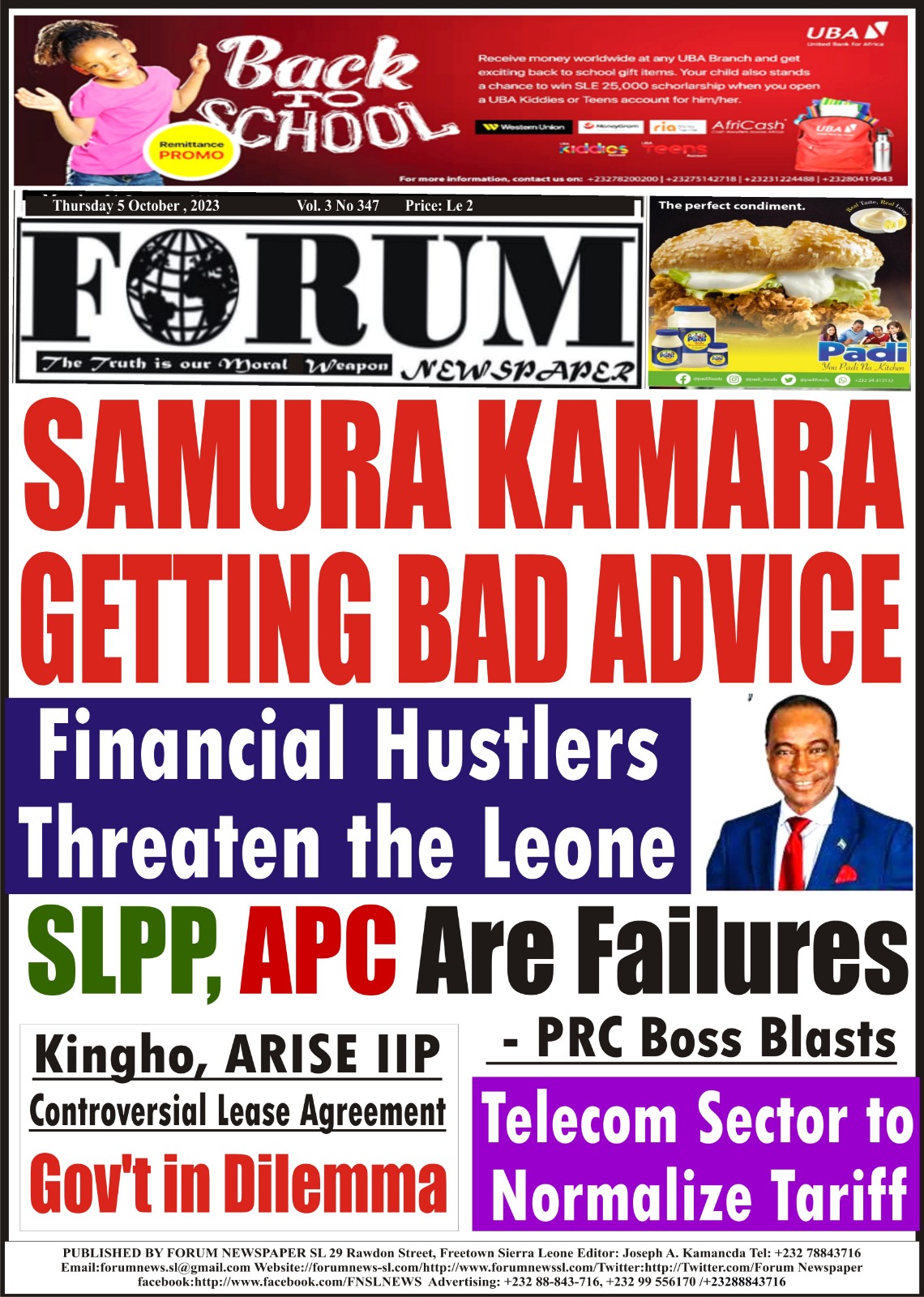

According to the Bank of Sierra Leone (BSL), brokerage firms are playing a very dangerous game with the exchange rate for the Leone which has been affecting the poor people of this country. These financial speculators are causing undue pressure on our Leone, which volatility has resulted to serious inflationary pressure on our economy. While there are several causes for the sad state of ours and the global economy, a previously unnoticed practice by local brokerage firms has all along been adding to our already bloated woes.

The actions of personnel at brokerage firms have caused a rippling effect on the prices of critical goods and services that we erroneously blame on the Bank of Sierra Leone or the government. According to the Bank, these brokerage firms usually bid at a higher rate of exchange of the Leone to international currencies, thereby generating unwarranted speculation and excess volatility of the exchange rate, with pass-through effect to domestic prices.

The consequent higher inflationary pressure fuelled by the excess volatility of exchange rate is adversely affecting the prices of essential commodities.

By making unguarded bids that present a different economic picture to what we are presently experiencing in Sierra Leone, especially in relation to importing and exporting, our Leone is made to look stronger, which strength is mere speculation as we do not garner enough forex from all our business dealings to offset the effects of a rise in the cost of foreign currencies to the Leone.

By making our Leone to appear stronger than it is affects the prices of other goods and services that a stronger Leone is supposed to cover.

This speculation creates unnecessary pressure on our economy thereby driving up inflation. The consequent trickling effect is felt on the prices of critical goods and services. Therefore, brokerage firms bidding at a higher rate of the Leone to the foreign currencies undermines the aspirations of the Bank and government to reduce poverty and enhance well-being of citizens.

According to the Bank of Sierra Leone, headline inflation continues to be driven by food and non-food inflation. The current inflationary situation can be attributed to an increase in imported food prices, energy cost and depreciation of the exchange rate. The price of imported food and fuel has increased significantly leading to a rise in the cost of fuel, transport and electricity. Inflation, which is at 56 per cent, is expected to be high until the end of 2023.

To curtail this very dangerous practice that will only continue to add to the prices of goods and services the Bank of Sierra Leone has decided, pursuant to section 48 of the Bank of Sierra Leone Act, 2019, section 1 of the Other Financial Services Act, 2001 and the Bank of Sierra Leone (Amendment) Act, 2023, to direct that all development project funds meant for Sierra Leone that are channelled through foreign exchange brokerage firms (international and local) shall be traded at the Reference or Average Market Rate (mid-rate) published daily by the BSL.